Electronic Components Procurement Strategies for Next-Gen Tech Products

The global consumer tech landscape is undergoing a seismic shift. By 2025, the wearable technology market alone will reach $64.3 billion, while AI-driven devices—from smart glasses to robotic companions—are redefining user experiences . Behind these innovations lies an unsung hero: the specialized electronic components that power them. For procurement professionals and OEMs, navigating this complex supply chain is now mission-critical.

Core Components Driving 2025’s Breakthrough Devices

AI Processors & Sensors: The Neural Engine

Edge AI Chips: NVIDIA’s Blackwell architecture GPUs (e.g., GeForce RTX 50 series) deliver 3x performance gains for real-time robotics and AR glasses

Multimodal Sensors: Bosch’s BMA255 accelerometers (0.005° tilt precision) and medical-grade MAX30205 temperature sensors (±0.1°C accuracy) enable health-monitoring wearables and smart bottles

Stretchable Sensors: A $5.8 billion market by 2025, essential for e-textiles and conformable health patches

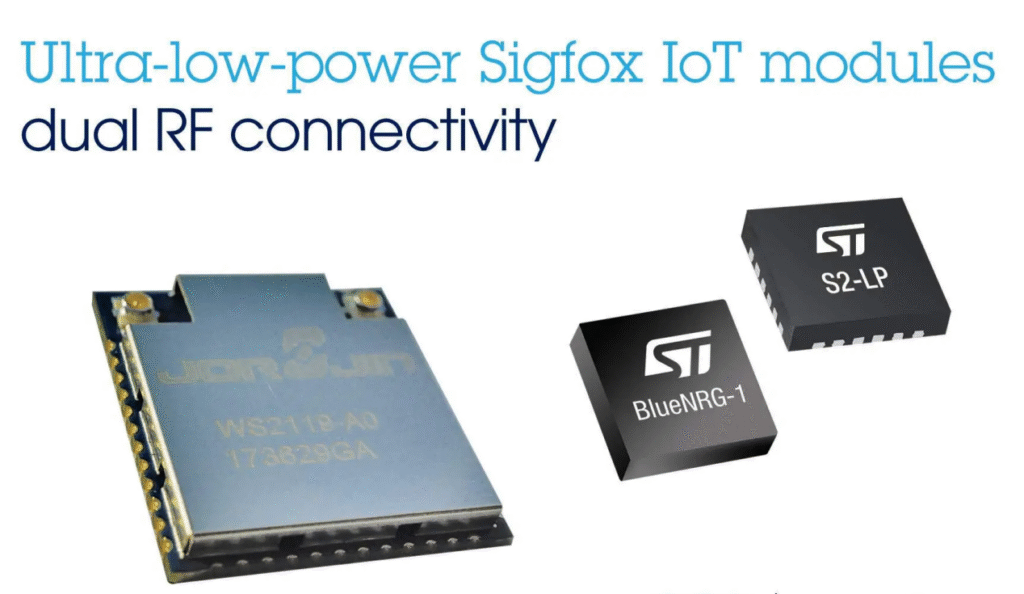

Connectivity & Power Modules

Bluetooth 5.0/LE: Nordic’s nRF52832 chips dominate TWS earphones (27.9% YoY growth) and IoT hydration trackers

GaN/SiC Power Devices: Critical for fast-charging EV infrastructure and compact consumer devices; market to hit $40B by 2025

Displays & HMI Controllers

Micro-LEDs: Hisense’s 116-inch TV uses 21,000 TriChroma LEDs for 10,000-nit brightness—tech now miniaturized for AR glasses

Voice ICs: NV040B (2μA standby) and WT588F02B-16S enable low-power medication reminders in smart health devices

Procurement Pain Points in 2025’s Market

Supply Volatility: Lead times for automotive-grade MCUs (e.g., NXP S32K) and TI PMICs stretch to 40+ weeks

Obsolescence Risks: 22% of IoT projects face redesigns due to discontinued RF modules like RO2166E SAW resonators

Certification Hurdles: Medical/FDA-compliant sensors (Maxim MAX30205) require rigorous validation for health tech applications

NES Group: Your Full-Cycle Component Partner

For OEMs developing AI glasses, robotic cleaners (e.g., Roborock Saros Z70), or smart health bottles, NES Group transforms supply chain fragility into resilience:

Proactive Inventory Buffering

Stockpiles 6+ months of critical components: STM32L4 MCUs, Kionix KX022-1020 accelerometers, and medical-grade sensors

Direct partnerships with Nuvoton, TDK, and Mcube ensure priority allocation during shortages

Intelligent Alternate Sourcing

Pin-to-pin swaps: Nordic nRF52832 for discontinued TI CC2541 Bluetooth modules

Cross-verification: Validates China made brands substitutes (e.g., Wavetron WT8012 touch ICs) with RF/thermal performance reports

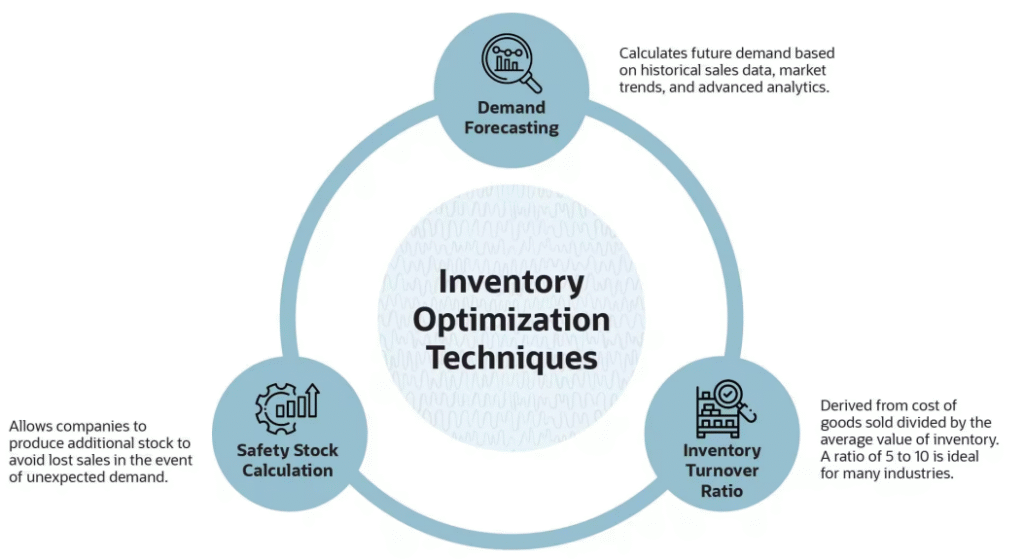

Circular Inventory Optimization

Resells 100% tested surplus: Bosch sensors, Holtek ICs, and BT modules from canceled projects, recovering 30%+ BOM costs

AI-driven demand forecasting aligns orders with production peaks, reducing overstock by 40%

*Case Study: A European smart bottle OEM faced BMA255 shortages. NES Group deployed KX022-1020 alternatives within 48 hours—zero line stoppage.

Future-Proofing Your Component Strategy

Prioritize Edge-AI Ready Chips: 2025’s AI PC penetration hits 34%—stock NPUs like Huawei’s Ascend series

Adopt Hybrid Sourcing: Blend 60% new + 40% certified-recycled components (GaN FETs, MEMS mics) for cost/sustainability balance

Leverage Compliance Networks: NES Group’s pre-certified pools (RoHS/REACH) accelerate EU/MEA market entry

Tech innovation isn’t just about silicon—it’s about supply chain intelligence. As 5G, AI, and IoT converge, partners like NES Group turn component chaos into competitive advantage.

Explore our component ecosystem for your next-gen product → NES Group IoT Procurement Solutions

No comment